Some Known Questions About Amur Capital Management Corporation.

Some Known Questions About Amur Capital Management Corporation.

Blog Article

The Main Principles Of Amur Capital Management Corporation

Table of ContentsThe Only Guide for Amur Capital Management Corporation6 Easy Facts About Amur Capital Management Corporation DescribedFacts About Amur Capital Management Corporation UncoveredAmur Capital Management Corporation for BeginnersGetting My Amur Capital Management Corporation To WorkThe Greatest Guide To Amur Capital Management Corporation

This makes genuine estate a rewarding long-term financial investment. Real estate investing is not the only method to spend.

Rumored Buzz on Amur Capital Management Corporation

Wise capitalists might be compensated in the kind of appreciation and dividends. Actually, considering that 1945, the typical big stock has returned close to 10 percent a year. Stocks truly can act as a long-term savings vehicle. That said, supplies can equally as quickly drop. They are by no indicates a safe bet.

That stated, genuine estate is the polar opposite pertaining to particular elements. Net revenues in genuine estate are reflective of your own activities.

Any type of cash obtained or shed is a direct outcome of what you do. Stocks and bonds, while usually lumped together, are basically different from one another. Unlike stocks, bonds are not representative of a risk in a business. Therefore, the return on a bond is dealt with and does not have the chance to value.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

The genuine advantage property holds over bonds is the moment structure for holding the financial investments and the price of return throughout that time. Bonds pay a fixed interest rate over the life of the investment, thus purchasing power with that interest goes down with rising cost of living with time (mortgage investment). Rental residential or commercial property, on the other hand, can create greater leas in periods of higher rising cost of living

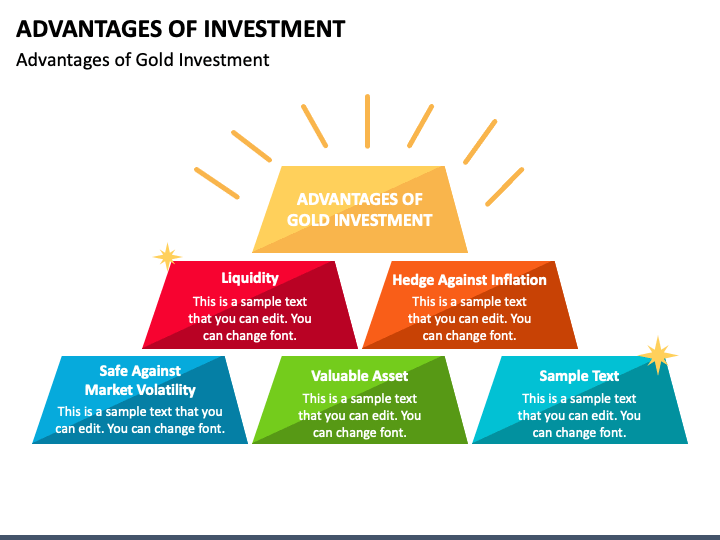

It is as basic as that. There will always be a need for the rare-earth element, as "Fifty percent of the globe's populace relies on gold," according to Chris Hyzy, chief financial investment policeman at U.S. Trust fund, the exclusive riches management arm of Financial institution of America in New York City. According to the World Gold Council, need softened in 2015.

Unknown Facts About Amur Capital Management Corporation

Consequently, gold costs should return down-to-earth. This ought to bring in creators looking to profit from the ground level. Acknowledged as a reasonably risk-free product, gold has actually established itself as an automobile to raise investment returns. Nevertheless, some do not even think Continue about gold to be a financial investment at all, rather a hedge versus rising cost of living.

Of course, as safe as gold may be taken into consideration, it still falls short to remain as attractive as realty. Below are a couple of factors capitalists prefer property over gold: Unlike real estate, there is no financing and, as a result, no space to take advantage of for development. Unlike property, gold recommends no tax obligation benefits.

Amur Capital Management Corporation Can Be Fun For Everyone

When the CD matures, you can accumulate the initial financial investment, together with some interest. Certificates of down payment do not appreciate, and they've had a historic average return of 2.84 percent in the last eleven years. Property, on the various other hand, can appreciate. As their names suggest, common funds contain finances that have actually been pooled with each other (alternative investment).

It is just one of the easiest methods to expand any portfolio. A common fund's performance is always determined in regards to complete return, or the sum of the modification in a fund's internet property value (NAV), its returns, and its funding gains circulations over a given amount of time. Nevertheless, just like supplies, you have little control over the efficiency of your assets. https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1712311217&direction=prev&page=last#lastPostAnchor.

As a matter of fact, putting cash into a shared fund is basically handing one's financial investment decisions over to an expert cash manager. While you can pick your financial investments, you have little claim over how they carry out. The 3 most usual ways to invest in property are as complies with: Acquire And Hold Rehab Wholesale With the worst part of the economic downturn behind us, markets have actually undergone historical appreciation rates in the last three years.

Amur Capital Management Corporation for Beginners

Getting low doesn't mean what it used to, and capitalists have actually acknowledged that the landscape is altering. The spreads that wholesalers and rehabbers have actually ended up being accustomed to are starting to create memories of 2006 when worths were historically high (capital management). Of program, there are still numerous opportunities to be had in the globe of flipping real estate, yet a new leave method has arised as king: rental buildings

Or else referred to as buy and hold properties, these homes feed off today's admiration rates and maximize the truth that homes are more pricey than they were just a couple of short years earlier. The idea of a buy and hold departure technique is easy: Investors will certainly look to boost their profits by renting out the residential property out and collecting regular monthly cash flow or merely holding the home till it can be sold at a later day for an earnings, of program.

Report this page